Money laundering is the key to cryptocurrency-based crime.The primary goals of cybercriminals who steal cryptocurrency, or accept it as payment for illicit goods, are to obfuscate the source of their funds and convert their cryptocurrency into cash so that it can be spent or kept in a bank.

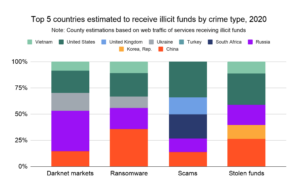

According to data provided in a recent Chainalysis report, the United States and Russia are in the lead when it comes to the total volume of laundered cryptocurrencies in 2020.

In terms of a specific crime type, Russia’s receipt of a disproportionately large share of darknet market funds, which is largely due to Hydra. Hydra is the world’s largest darknet market by revenue, and exclusively serves Russia and other Russian-speaking countries in Eastern Europe.

China also stands out for receiving a disproportionate share of funds sent from addresses associated with stolen funds and ransomware. Some of this may come from cryptocurrency theft and ransomware activity associated with Lazarus Group, a cybercriminal syndicate linked to the North Korean government. A recent Department of Justice complaint identified two Chinese nationals who worked with Lazarus Group operatives to launder cryptocurrency that the group stole from exchanges. Other China-based cryptocurrency users could be engaged in similar activity.

The United States comes in second place in the dark web category, but it has a huge lead in the volume of cryptocurrencies laundered by scammers, however, it is slightly overrepresented in funds received from addresses associated with scams and stolen funds.

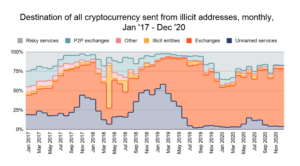

Finally, according to the report, 55% of all illicit funds moving to services end up at deposit addresses for which illicit addresses supply 50% or more of all funds. That figure rises to 71% for deposit addresses with 30% or more of all funds received coming from illicit addresses. In other words, a significant share of money laundering in cryptocurrency isn’t flying under the radar at big services who can’t sift through transactions to spot it, but is being actively facilitated by nested services for whom money laundering is a key part of the business model.