Uniswap’s UNI token experienced a meteoric surge, escalating by a staggering 62% on Friday morning following a groundbreaking proposal by the Uniswap Foundation. The proposal, aimed at fortifying the decentralized exchange’s (DEX) governance structure, revolves around a fee mechanism designed to incentivize UNI token holders who have staked and delegated their tokens.

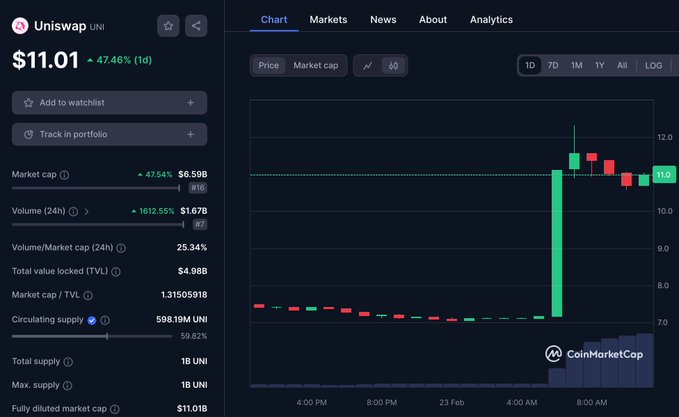

The governance lead of the foundation, Erin Koen, unveiled the proposal, igniting a frenzy in the cryptocurrency market. UNI’s price catapulted from $7.18 to $11.01, as per data from CoinMarketcap.

Should the governance proposal receive the green light, two innovative Uniswap smart contracts will autonomously collect protocol fees and distribute them pro-rata to UNI token holders who have staked and delegated their votes.

Remarkably, over the past 180 days, Uniswap has amassed approximately $305.8 million in fees, according to insights from Token Terminal. Antonio Juliano, the visionary mind behind decentralized exchange dYdX, elucidated potential revenue streams, estimating figures ranging from $61 million to $153 million annually.

🔈 New Governance Proposal Posted 🔈

UF Governance Lead @eek637 just posted a proposal to upgrade Uniswap Protocol's governance system. Specifically, this upgrade would reward UNI holders who have staked and delegated their tokens.

— Uniswap Foundation (@UniswapFND) February 23, 2024

Nevertheless, the proposal is not without its challenges. Addressing the existential risks posed by free-riding and apathy within Uniswap’s governance system, the proposal seeks to enhance engagement and participation among token holders.

As the proposal gains traction, community members are actively engaging in discussions regarding its implications. In seven days, a Snapshot will be conducted to gauge community sentiment, potentially paving the way for an on-chain vote to determine the fate of this transformative upgrade.

In an era marked by decentralized innovation, the Uniswap Foundation champions the cause for resilient and engaged governance, recognizing its pivotal role in ensuring the long-term vitality and prosperity of the protocol.