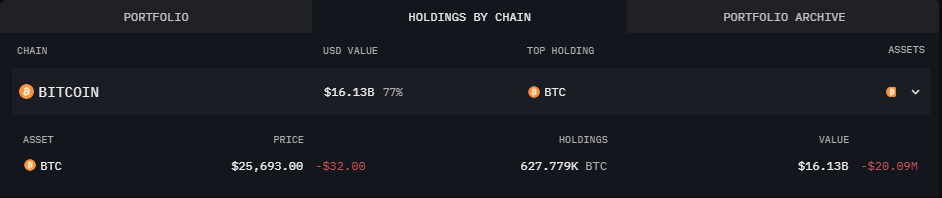

Arkham Intelligence, a leading blockchain analytics firm, has revealed that Grayscale Bitcoin Trust (GBTC) now holds the position of the world’s second-largest holder of Bitcoin (BTC), with a reported total of over $16 billion in assets.

Arkham Intelligence, a leading blockchain analytics firm, has revealed that Grayscale Bitcoin Trust (GBTC) now holds the position of the world’s second-largest holder of Bitcoin (BTC), with a reported total of over $16 billion in assets.

Arkham’s breakthrough discovery comes after meticulous tracing of GBTC’s Bitcoin holdings across the blockchain. The company identified more than 1,750 addresses associated with GBTC, each containing less than 1,000 BTC. This revelation defies Grayscale’s previous reluctance to disclose its on-chain addresses due to security concerns.

Grayscale’s officially reported figure of 627,779 BTC aligns seamlessly with Arkham’s findings, reaffirming the authenticity of their discovery. This revelation has sparked considerable interest, as Grayscale’s pursuit to convert GBTC into a spot Bitcoin exchange-traded fund (ETF) has gained significant momentum.

Breaking: Arkham has identified the Grayscale Bitcoin Trust’s holdings on chain.

It is the 2nd largest BTC entity globally, holding >$16B of BTC.

Though Grayscale publicly reports balances, they have refused to identify the on-chain addresses of the trust. https://t.co/uEN4kNldpm pic.twitter.com/p9GfrthoKR

— Arkham (@ArkhamIntel) September 6, 2023

Last week, Grayscale secured a victory in a lawsuit against the U.S. Securities and Exchange Commission (SEC), furthering its quest to gain approval for the ETF. In response to the court’s decision, Grayscale has formally requested a meeting with the SEC to present its case, highlighting the lack of differentiation between a Bitcoin futures ETP and a spot Bitcoin ETP.

Grayscale’s entity page on Arkham shows it is carrying 627,779,000 BTC valued at over $16 billion.This is similar to the amount claimed on Grayscale’s website, implying that it does have enough Bitcoin to satisfy withdrawals.

Meanwhile, the SEC has delayed its decision on six other spot Bitcoin ETF applications until October. Notable applicants in this list include BlackRock, Fidelity WisdomTree, Bitwise, VanEck, Invesco Galaxy, and Valkyrie. Grayscale’s newfound status as the second-largest BTC holder will undoubtedly influence the ongoing discussion surrounding the future of cryptocurrency ETFs.

This revelation marks a significant milestone in the world of cryptocurrency and institutional investment, potentially paving the way for further advancements in the acceptance of Bitcoin-based ETFs.