The price of cryptocurrencies may be well off from their all-time highs. But that has not deterred institutional investors from betting on the emerging industry, according to data published by asset management firm CoinShares.

The price of cryptocurrencies may be well off from their all-time highs. But that has not deterred institutional investors from betting on the emerging industry, according to data published by asset management firm CoinShares.

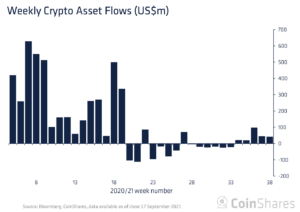

In its weekly report, the firm noted that crypto funds recorded a fifth consecutive week of inflows in the period ending Sept. 17. The current streak comes off the back of a lengthy six week period in which funds largely saw outflows from investors taking profits on their crypto bets from earlier in the year.

(Source: CoinShares)

According to CoinShares, covered funds include Bitcoin and crypto-related exchange-traded products (ETPs), mutual funds, and other over-the-counter (OTC) products referencing crypto assets. In total, asset investment products saw an inflow of $42 million in the past week, with $15 million of that value going into bitcoin.

The inflow into BTC marks only the third time in 16 weeks that the leading cryptocurrency has seen a net positive inflow, and continues a steady decline in its market share. Bitcoin’s total market share across the tracked products had dropped from 81% to 67% as per the report.

The majority of investments flowed into altcoins, suggesting that institutional investors are optimistic about the future of alternative blockchain networks. For instance, despite the Solana network suffering a network outage in the past week, Solana-based investment products received a total inflow of $4.8 million.

While alluding to the improved sentiments among institutional investments, CoinShares’s James Butterfield warned “that the improved sentiment could be a seasonal phenomenon, [since] we are not seeing a commensurate rise in volumes in investment products.”

He suggests that the inflows are simply because “investors are taking advantage of recent price weakness and the continued rise in alt-coin popularity.”

Bullish crypto investors will be hoping for increased inflows in a week that has started on a slightly sour note for global markets. The entire crypto market lost roughly $200 million of its market cap following a broad sell-off led by uncertainties in the Chinese credit market.