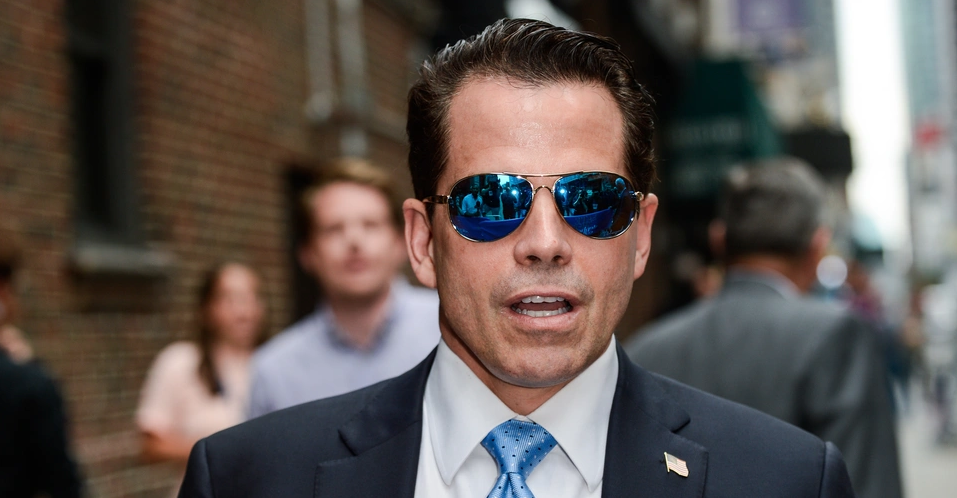

SkyBridge Capital a New York based fund founded by former White House Communication Director

Anthony Scaramucci has registered with the US Securites and Exchanges Commission.

The SkyBridge Capital Fund has invested $25 million in Bitcoin and will welcome investments from outside investors beginning January 4th, 2021.

Scaramucci recently discussed his feelings regarding Bitcoin and the volatility of the cryptocurrency ecosystem in an interview with CNN MarketNow

Scaramucci: Bitcoin is due for a correctionCNN.com

Scaramucci told CNN’s Alison Kosik “He has spent 2 to 3 years studying Bitcoin and the cryptocurrency ecosystem. He said, “He believes that Bitcoin’s best days are ahead but the ride will be volatile”.

Again on a CNBC’s interview, He said “We would have loved to have deployed the fund three or four months ago,” but believes that Bitcoin has not yet reached its peak. “This is something that has crashed upwards in the last two-and-a-half to three weeks,”

Scaramucci joins a now growing list of major financial institutions moving into Bitcoin and other cryptocurrencies. The SkyBridge Fund, however, will only open to so called accredited investors.

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status or professional experience. In the U.S., the term accredited investor is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings.

SkyBridge was set up in 2005 and is based in New York, it manages $9.3 billion in assets.