Multiple US banks encountered deposit delays on Friday, originating from an error within the payment processing network, as reported by the Federal Reserve.

Multiple US banks encountered deposit delays on Friday, originating from an error within the payment processing network, as reported by the Federal Reserve.

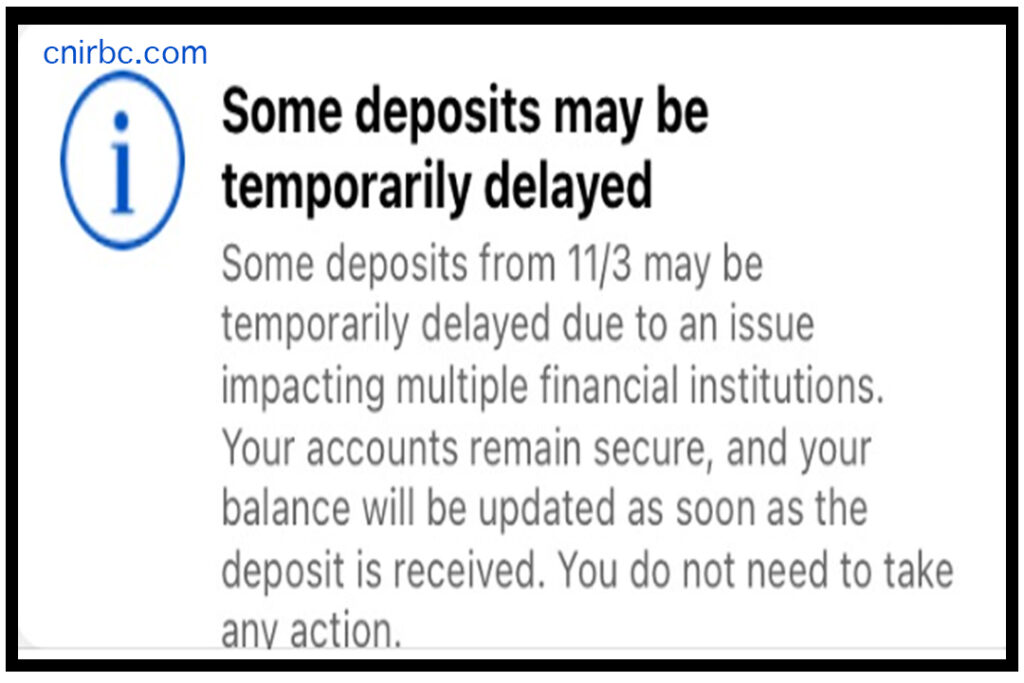

Bank of America, one of the affected institutions, promptly notified its customers about potential deposit delays, attributing the issue to a problem that was impacting several banks.

Chase also acknowledged that some of its direct deposits had not updated as expected. Meanwhile, customers at Bank of America, Chase, US Bank, Truist, and Wells Fargo raised complaints about these issues on Friday morning, further highlighting the widespread nature of the problem. The Bank of America customers received this message when they checked their bank accounts online to confirm their deposits.

The root cause of the delay was traced back to the Automated Clearing House (ACH) network, which is managed by the Federal Reserve Banks. This network glitch led to temporary deposit delays, causing concern among both banks and their customers.

Customers at Big Banks Report Account Problems https://t.co/6cnJYkcPCb

— ThinkAdvisor (@ThinkAdvisor) November 3, 2023

In the midst of these challenges, there is increasing interest in central bank digital currencies (CBDCs), often referred to as “fedcoin.” These digital currencies have the potential to revolutionize the banking landscape. CBDCs operate on secure, transparent blockchain networks, utilizing blockchain technology to create immutable transaction records. This innovation ensures that all transactions are securely recorded on a decentralized ledger, making it impossible to modify or tamper with the data.

However, it’s important to note that CBDCs can induce changes in retail, wholesale, and cross-border payments that may have negative spillover effects on monetary policy. These effects include alterations in money velocity, bank deposit disintermediation, volatility in bank reserves, currency substitution, and capital flows.

As the banking industry navigates these challenges, CBDCs offer a potential solution for enhancing transaction security and transparency, though their broader impacts on monetary policy remain a topic of ongoing discussion. Stay tuned for further updates on this developing situation and the evolving role of CBDCs in modern banking.